Last week as we had the final week of August the prospect of rate cuts drove a risk on approach. We saw major indexes move back towards their highs.

The move higher was driven as expectations of rate cuts from both the Fed and ECB. This is against a backdrop of a worsening economic situation in both areas which pushed yields higher.

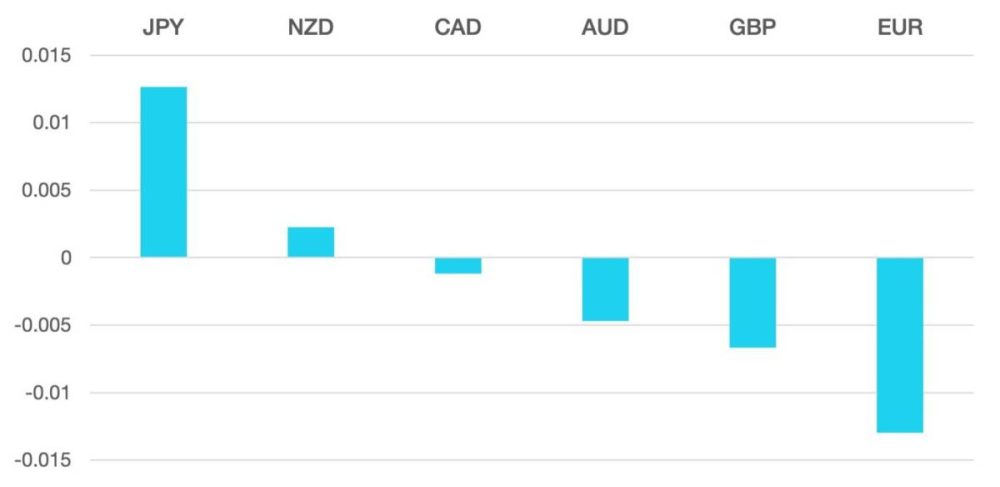

The Euro ended the week the worst performer as the market begins to price in a more aggressive than expected rate cut cycle by the ECB. This weighted heavily on the single currency as it lost more than 1% in the week.

Yen was the second worst as it struggles against the pressure of US yields rising.

NZD was the strongest performer showing resilience post RBNZ rate cuts earlier in the month and the earlier month volatility. The rate cut is viewed as giving the New Zealand economy a well needed boost and thus could see rates held for longer as opposed to other economy cutting cycle which we are now entering.

Oil saw weakness. Late in the week a story of a supply increase by OPEC+ sent oil lower losing any gains for the week and pushing it to a 1.8% loss on the week to close just about $73.50.

The week ahead is busy for data as a new month starts. We have PMI and US payrolls on Friday.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Rate Cuts Drive End of August Rally first appeared on trademakers.

The post Rate Cuts Drive End of August Rally first appeared on JP Fund Services.

The post Rate Cuts Drive End of August Rally appeared first on JP Fund Services.